The international monetary system of the 21st century should be understood as Offshore US Dollar System. This arrangement has gradually evolved since the 1950s and replaced the state-planned Bretton Woods System when it collapsed in the 1970s. Today, international monetary affairs are primarily organized through private banks and shadow banks that use the US dollar as the unit of account and operate offshore, outside of the US monetary jurisdiction.

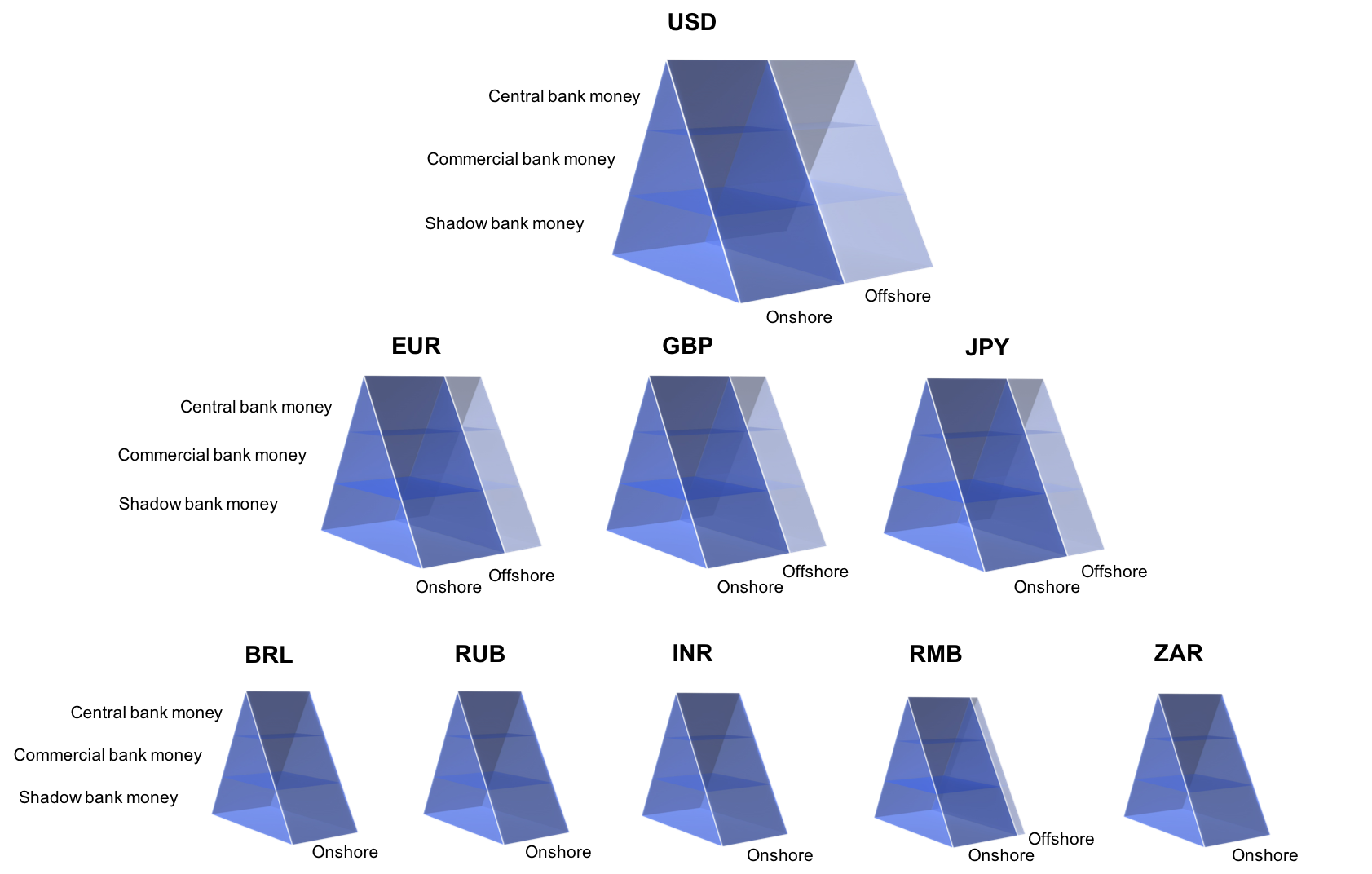

The international monetary system is the key infrastructure that enables the global trade in goods and services, as well as global financial flows. It has its center in New York and operates primarily on the basis of the US-Dollar (USD). We can think of the international monetary system as a hierarchical structure with the USD at the top. The currencies of other monetary systems form a multilayered periphery to it. More central currencies are the Euro (EUR), the Japanese Yen (JPY) and the British Pound (GBP). Further down in the hierarchy, we can find for example the currencies of the BRICS: the Brazilian real (BRL), the Russian ruble (RUB), the Indian rupee (INR), the Chinese renminbi (RMB) and the South African rand (ZAR). These currencies are created by the respective central banks and commercial banks, but also by shadow banks—non-bank financial institutions that perform similar activities like banks but are regulated differently. Central bank money is scarcer than commercial bank money, which in turn is scarcer than shadow bank money—hence the representation as pyramids.

The international monetary system of the 21st century is a privatized offshore US dollar system.

The internationally dominant currencies are also created and used ‘offshore’, outside the actual legal jurisdiction of the home country. Offshore money creation greatly enhances the international outreach of a currency and the ability of the currency’s home country to influence and interfere with other states. By far the most wide-spread offshore currency is the USD. Today’s international monetary system effectively is an offshore USD system, in which various types of banks create US Dollars everywhere in the world, also in Europe. The key roles play the so-called Eurodollar market and the globally entangled USD-based shadow banking system. Since the 2008 crisis, the US central bank stabilizes this system with swap lines to other non-US central banks to deliver USD emergency liquidity to the offshore world if necessary.

A brief history of the offshore US dollar system

The US dollar, the unit of account located at the top of the international monetary hierarchy, today is created by central banks, commercial banks and shadow banks both onshore and offshore. Hence, the offshore US dollar hierarchy symmetrically mirrors the onshore US dollar hierarchy. This is a very recent development. How has this institutional setup come about?

The first step in the rise of the offshore dollar system was the emergence of the ‘Eurodollar market’ or—more accurately—the market for offshore USD deposits. Established in the mid-1950s, this market translated the onshore credit money creation in the form of USD deposits by US commercial banks into the offshore dollar realm, located first and foremost in the City of London, where it was built on pre-existing structures of the Victorian bill market. In the 1960s, large New York banks discovered the Eurodollar market as a means to circumvent the strict domestic banking regulations established at the end of the Great Depression. The Eurodollar market, which then was no longer limited only to London but extended to many other financial centres worldwide, became a complement to the domestic US money market.

In the 1970s, with the rise of what today is called shadow banking system, new forms of private credit money emerged as substitutes for bank deposits. With its transnational structure, shadow banking does not adhere to the traditional state boundaries in monetary affairs. Major shares of the associated creation of ‘shadow money’—most notably money market fund (MMF) shares and asset-backed commercial papers (ABCPs)—are located offshore. Moreover, foreign exchange (FX) swaps are an instrument that may be considered, analagous to repurchase agreements, to be a means for creating credit money substitutes specifically in the offshore dollar realm and thus also represent a form of offshore shadow money.

In the 2007-9 Financial Crisis, a global bank run emerged during which holders of USD-denominated shadow money forms and offshore deposits tried to convert their credit money balances into onshore USD deposits, which were under the protection of the Federal Reserve and the US deposit insurance. To tame the run, authorities intervened in a multitude of ways. One of them was to establish emergency swap lines with non-US central banks in whose jurisdictions offshore dollar creation took place. Effectively, the Fed put those central banks in the position to autonomously create USD-denominated public credit money on their balance sheets and lend it on to domestic banks engaged in offshore dollar creation. Some of these temporary swap lines were made permanent after the crisis and are still in place, effectively allowing non-US central banks to create USD deposits on their balance sheet upon their own discretion to an unlimited extent. Therefore, since the 2007-9 Financial Crisis, through gradual institutional evolution, the offshore dollar realm has come to fully mirror the domestic US credit money system, with USD-denominated credit money created offshore by central, commercial and shadow banks.