The European Monetary Union is a unique experiment in monetary history. Its initial design only made central bank money truly European, but left commercial bank and shadow bank money predominantly national. After a decade of smooth sailing, it entered into crisis mode in 2009 and has never fully recovered. Through endogenous change and political interventions, it now has an architecture that nobody has planned. It is continuously transforming and difficult to govern.

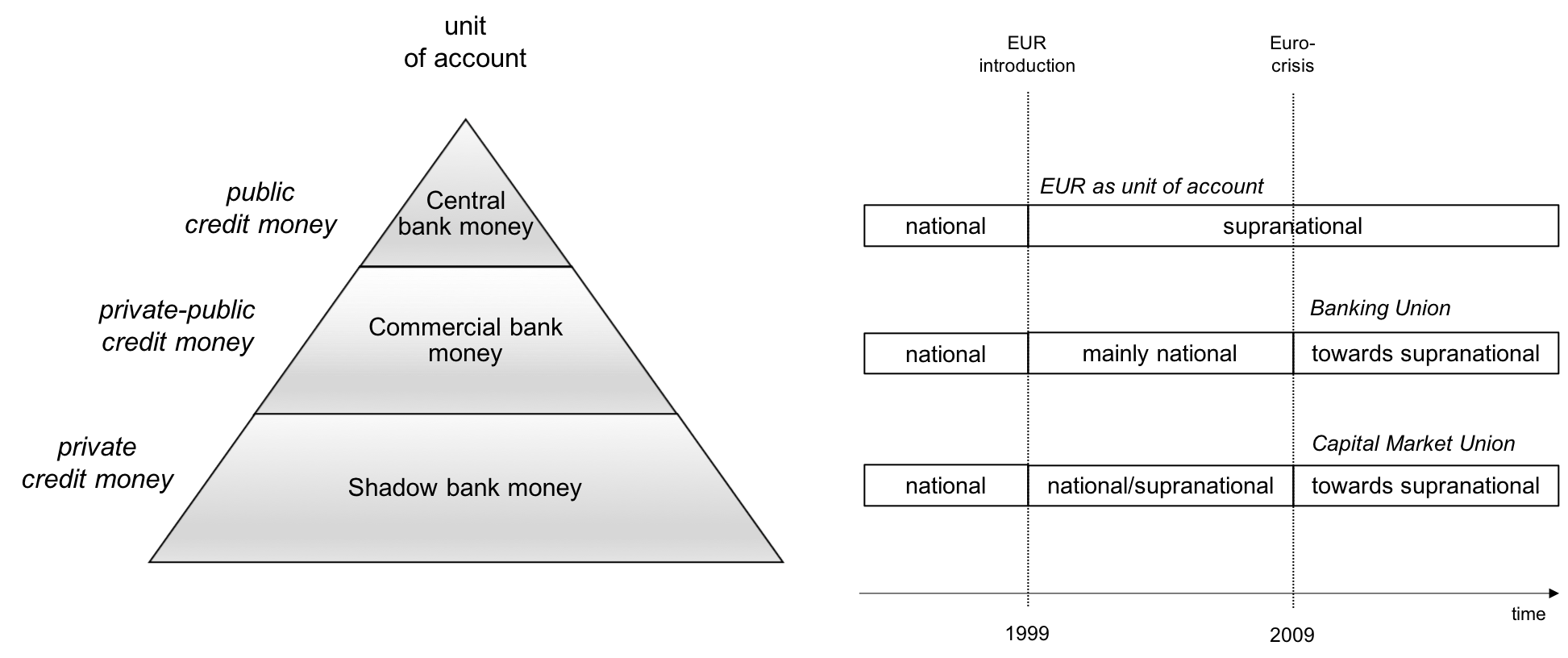

Europe’s money supply, as in any credit money system, is hierarchical and a public-private hybrid. It is hierarchical because it is made up of three types of credit money that co-exist next to each other. At the top of the hierarchy stands central bank money (currency and central bank deposits). Below them come commercial bank money (deposits) and money forms issued by non-bank financial institutions (‘shadow banks’). The most important shadow money form today are repurchase agreements (‘repos’). The hierarchy permeates the public-private hybridity: While central bank money is issued by public institutions, commercial and shadow bank money are issued by private institutions. For commercial bank money, however, a public-private framework is in place to protect and regulate deposit creation.

The European Monetary Union is incomplete because its initial design only made central bank money European. Commercial bank and shadow bank money remain scattered across the EU’s multilevel governance structure.

Before the European Monetary Union was introduced, the creation of central, commercial and shadow bank money was nationally organized. All EU member states had their own units of account that they used to denominate their credit money forms (Italian lira, French franc, Deutsche Mark, …). In 1999, the Eurozone member states adopted the Euro (EUR) as common unit of account. This monetary architecture, designed with the 1992 Treaty of Maastricht, uploaded central bank money as public credit money situated at the top of the monetary hierarchy on a supranational European level. Currency and central bank deposits became directly issued by the European Central Bank (ECB). However, the integration of private-public and private credit money in the form of commercial bank and shadow bank money was merely patchwork, with competences remaining scattered across the national and supranational level. European monetary integration thus remained incomplete because it neglected the private side of the money supply.

The Eurocrisis

The Eurocrisis

The Eurocrisis emerging in 2009 exposed the architectural weakness of the European Monetary Union. It led to multiple problems in Europe’s banking and shadow banking sector, with hidden runs on the lower levels of the hierarchy. In its peak phases, the Eurocrisis endangered par, the implicit one-to-one exchange rate between the private credit money forms of different Eurozone member states, and almost provoked a break-up of the monetary union.

Banks create deposits in a public-private partnership that comprises public liquidity and solvency backstops as well as measures for bank supervision and regulation. In the original design of the European Monetary Union, only liquidity backstops became supranational. The other elements remained scattered across regulatory levels, leading to a divide among Eurozone member states. This became obvious in the Eurocrisis. Bank lending across Eurozone countries dried out, and deposits concentrated in surplus countries, which were perceived as safe havens.

The architecture of the European Monetary Union had some features to cushion the effect. The TARGET2 system allowed to create extra liquidity and developed into a central bank emergency backstop facility. The breakdown of private credit money creation has thus been partly cushioned by the creation of public credit money. In parallel, the European Central Bank announced emergency measures to sustain par among surplus and deficit euros.

The EU Commission later pushed for the introduction of the Single Rulebook for bank regulation and the project of a Banking Union, which however will only become effective in a reduced version. These processes may entail an upload of the public-private framework for deposit creation to the European level as a functional spill-over of EU integration. The actual impact on the architecture of the European Monetary Union remains to be seen.

With the introduction of the European Monetary Union, policy-makers had ambitious plans to create a liquid market for repurchase agreements (repos), the key shadow money form in Europe. Repos are debt instruments constructed around the sale and re-purchase of collateral, typically Treasury bonds or securitized private debt. The repo market was seen as a vehicle for further financial integration and the backbone of the Eurozone’s new financial order.

Yet, in the early years of the European Monetary Union, substantial differences between France, Germany and small member states hampered repo integration. In particular, repo issuance remained nationally fragmented because there was no supranational public debt (Euro Treasury bonds) that could serve as homogenous collateral. The ECB tried to brush over this shortcoming by declaring all sovereign bonds in the Eurozone to be equal repo collateral. This granted preferential treatment to peripheral Eurozone members and implicitly created a synthetic Eurozone high-quality public asset, but did not involve any changes in national autonomy over the issuance of public debt.

In the Eurocrisis, this arrangement for shadow money creation fell apart. The run on repo during the 2007-9 Financial Crisis spilled over to Europe, fragmented the Eurozone’s repo market and demonstrated that the ECB’s basket, in which all Eurozone members’ public debt was equal repo collateral, was a fair weather construct. The crisis had detrimental effects on the European repo market and created massive financial strains within the EU.

The ECB first behaved procyclically and failed to relax the strains on repo. Its Quantitative Easing (QE) programme, in turn, can be interpreted as a reaction to compensate for the defaulting repo market. QE is a form of shadow banking on public balance sheets as it creates public credit money by swapping IOUs and conducts money market funding of capital market lending. On the other hand, the EU’s plan for Capital Market Union is an attempt to revamp the repo market and compensate for the Eurozone's struggling deposit banking system. In absence of Eurozone Treasury bonds, the strategy leans again towards using securitized private debt as collateral.

The transformation of the European Monetary Union’s architecture

In the meantime, the unfolding of the Eurocrisis and the political interventions have substantially transformed the architecture of the European Monetary Union. It neither corresponds to the blueprint envisioned in the Treaty of Maastricht, nor is it comparable to the construct put in place in 1999.

The pre-crisis macroeconomic consensus no longer exists, the ECB has been navigating uncharted territory with negative interest rates and Quantitative Easing; this raises new questions about the relationship of monetary and fiscal policy. The TARGET2 balances have become an integral feature to sustain the cohesion of the currency union. Banking Union has been partly introduced, but a truly European deposit insurance is not currently in sight. Capital Market Union seeks to revamp the European repo market by re-introducing securitization techniques and strengthening the Eurozone parallel banking system.

The architecture of the European Monetary Union is unprecedented in history and continuously transforming. We need fresh ideas to make it fit for the future.

We currently have only a limited understanding of the way in which the architecture of the European Monetary Union works, how it transforms and how its governance can be improved. By contrast, the political debates on the future of the European Monetary Union have stalled between three different suboptimal scenarios:

- continued muddling-through with ever stronger rules that are not seen as credible or feasible in the long run, while further aggravating the existing imbalances;

- full fiscal union and joint debt issuance, which seems neither politically likely nor desired by the European populace; or

- monetary disintegration with a break-up of the EMU, as called for by an increasing number of (populist) voices.

We are in dire need for new creative ideas to positively influence the systemic transformation of the European Monetary Union’s architecture to find a better, more sustainabe and more equitable monetary architecture for Europe.