My research revolves around the political economy of the modern credit money system. How it works, how it transforms, and how it can be governed. I approach it from the perspective of institutionalist International Political Economy and use the conceptual lens of the Money View, a contemporary credit theory of money.

Credit money is a spectrum of debt instruments that changes over time. I am particularly interested in instruments at the edge of the spectrum, “shadow money”. It is here where things get blurry and problems of defining money are part of the phenomenon itself.

I have developed the ‘monetary architecture’ framework which allows visualizing the monetary and financial system as a web of balance sheets that interlock via different credit instruments. A ‘monetary architecture’ typically comprises central banks, commercial banks, non-bank financial institutions, as well as a fiscal ecosystem made up of treasuries and off-balance-sheet fiscal agencies. It is possible to ‘map’ the institutional configurations of monetary architectures in different geographical areas and at different points in time.

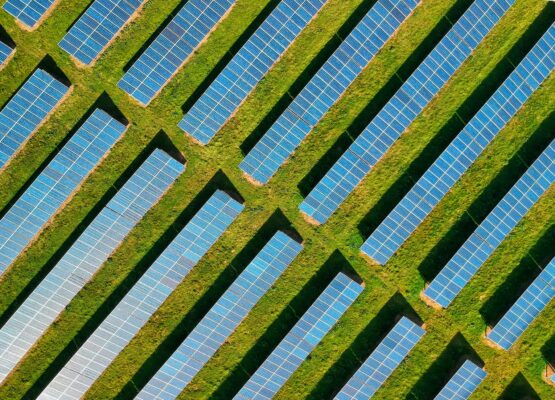

In my work, I address four major themes: private credit money accommodation (how the balance between public and private money changes through financial crises), the international monetary system (how monetary affairs are organized beyond the classical nation state), the European Monetary Union (how monetary questions are addressed in the process of European integration), and financing large-scale transformations (how states can use modern monetary architectures to pay for wars, reconstruction, or the Green Transition).